A Comprehensive Guide to Zakat Calculation

Understanding the Foundations of Zakat

Did you know that approximately 1.9 billion Muslims worldwide are obligated to give zakat, which translates to a staggering $600 billion annually? That's more than the GDP of many countries! Yet, despite this massive potential for impact, many still struggle with how to accurately calculate their zakat.

Let's face it: navigating the rules of zakat can feel like trying to solve a Rubik's Cube blindfolded. Between determining your zakat nisab and figuring out what wealth qualifies, it's easy to feel overwhelmed. But once you grasp the underlying principles, everything starts to click.

The Concept of Nisab

At its core, zakat is about wealth purification. The nisab is the minimum amount of wealth you must possess before you're required to pay zakat. It acts as a safety net, ensuring that only those who have sufficient means contribute to this important form of Islamic charity. For example, in India, the nisab is often calculated based on the current market value of gold or silver—so keep an eye on those prices!

What Counts as Wealth?

When calculating zakat, not all assets are created equal. Cash in your bank account? Definitely counts. Stocks and shares? You bet! But what about that shiny gold necklace you wear on special occasions? Yes! Zakat on gold is crucial here; it's not just jewelry—it's part of your wealth that needs purification too.

- Cash and savings accounts (zakat on savings)

- Investments in stocks and bonds

- Gold and silver holdings (consider using a zakat calculator for accurate amounts)

- Business assets and inventory

Remember: if it has value, it likely counts towards your zakat calculation.

Zakat Calculator – Your New Best Friend

Zakat calculator tools are game changers for anyone looking to simplify their annual zakat calculation process. These online tools can help you quickly assess your obligations based on current values and your financial situation. Whether you're using a comprehensive zakat guide India or an Islamic charity calculator tailored for your region, these calculators provide clarity amidst the chaos.

How to calculate zakat doesn't have to be a daunting question anymore. By leveraging these digital tools alongside knowledge about zakat rules and nisab thresholds, you can approach this annual obligation with confidence.

Determining Zakat Nisab: The Threshold for Obligation

Imagine waking up one day and realizing you've been giving zakat for years without ever checking if you even hit the nisab threshold. That's like throwing a birthday party for your pet goldfish—nobody's coming, and it's just a waste of cake! Understanding zakat nisab is crucial because it determines whether you're even obligated to pay zakat in the first place.

What Exactly is Nisab?

Nisab is the minimum amount of wealth a Muslim must possess before they are required to pay zakat. Think of it as a financial checkpoint. If your wealth dips below this threshold, congratulations! You can take a breather from your zakat obligations until your finances bounce back. In India, the nisab is often pegged to the current market value of gold or silver—so yes, keep an eye on those fluctuating prices!

As of now, the nisab is generally equivalent to 87.48 grams of gold or 612.36 grams of silver. With gold prices hovering around ₹5,000 per gram (prices may vary), that puts the nisab at roughly ₹437,400 for gold. If your total assets fall below this figure, you can skip out on paying zakat.

How to Calculate Your Nisab

Calculating your nisab isn't rocket science; it's more like baking a simple cake—just follow the recipe! Here's a quick step-by-step guide:

- Check the current market price of gold or silver.

- Multiply that price by the amount needed for nisab (87.48 grams for gold or 612.36 grams for silver).

- Compare this value with your total wealth (cash, savings, investments).

Pro tip: Use an online nisab calculator to streamline this process.

The Importance of Accurate Calculation

But why does it matter? you might ask. Well, knowing whether you meet the nisab threshold can save you time and money—think about all those extra lattes you could buy instead of giving unnecessary zakat! Plus, understanding this aspect ensures you're fulfilling your religious duty accurately.

But what if I'm right on the edge? If you're hovering just above or below the threshold due to fluctuating asset values—like that rollercoaster ride at an amusement park—you might want to consult with knowledgeable folks in your community or use an accurate zakat calculator online.

Asset Types Subject to Zakat

You might think that calculating zakat is just about counting cash, but here's a shocker: it's much more intricate than that! Did you know that many Muslims overlook significant assets when determining their zakat obligations? It's like forgetting to include your prized collection of vintage comic books when doing a spring cleaning—those treasures still count!

Cash and Bank Savings

Let's kick things off with the most straightforward asset: cash. Money sitting in your bank account? Yep, that's definitely zakatable! This includes savings accounts and any cash you have on hand. The zakat percentage on this is typically 2.5%, so if you have ₹100,000 saved up, you're looking at a ₹2,500 obligation. Easy peasy, right?

Investments and Business Assets

Next up are investments—stocks, bonds, and mutual funds. If you're dabbling in the stock market or have a portfolio of mutual funds, these assets are also subject to zakat. Let's say you own shares worth ₹200,000; that's another ₹5,000 added to your zakat calculation. And don't forget about business assets! If you own a shop or a service-based business, the value of your inventory and equipment counts too.

Gold and Silver Holdings

Ah, the shiny stuff! Gold and silver are not just for adornment—they're also part of your wealth that needs purification through zakat. Whether it's jewelry or bullion bars, if it has value and is above the nisab threshold, it counts! In India, for example, if you have gold worth ₹150,000 lying around (and let's be honest—who doesn't?), that translates into another ₹3,750 owed in zakat.

Pro tip: Use a zakat calculator online to figure out how much zakat you owe on these assets accurately.

Real Estate and Other Assets

But wait—there's more! Real estate can get tricky. If you're renting out properties or land for income generation purposes (think Airbnb), then yes—those assets are also subject to zakat! However, if it's your primary residence where you live, then you're off the hook.

- ₹ Cash in bank accounts (zakat on savings)

- ₹ Stocks and investment portfolios (calculate zakat based on current market value)

- ₹ Gold and silver holdings (don't forget about those bangles!)

- ₹ Business assets including inventory and equipment

So next time you're ready to calculate your zakat using an Islamic finance calculator or any online tool like a zakat eligibility calculator or easy zakat calculation app—make sure you've got all bases covered!

Calculating Zakat on Income and Wealth

Here's a shocking fact: over 50% of Muslims admit they have no idea how to accurately calculate their zakat obligations. That's like trying to bake a cake without knowing the recipe—good luck with that! The process of calculating zakat on income and wealth can seem daunting, but it doesn't have to be.

Let's break it down. First off, you need to know that zakat isn't just a one-size-fits-all percentage; it's based on your total net worth and income over the year. Think of it as a financial spring cleaning—you're not just looking at what you have in your wallet but everything that qualifies as wealth.

Understanding Your Total Wealth

So what exactly counts towards your total wealth? Spoiler alert: it's more than just cash in hand! Here's the lowdown on what you should include:

- Cash in bank accounts (yes, even that rainy-day fund)

- Investments such as stocks and bonds (your future self will thank you)

- Gold and silver holdings (not just for bling!)

- Business assets including inventory and equipment

Pro tip: If it has value, it likely counts towards your zakat calculation.

The Zakat Percentage

So how much should I actually give? This is where the magic number comes in: the zakat percentage is typically set at 2.5% of your total qualifying wealth. If you've got ₹100,000 saved up, you're looking at a ₹2,500 obligation. Simple math, right?

But wait, you might say. What if my wealth fluctuates throughout the year? Great question! The ideal approach is to calculate zakat based on your total assets at the end of your lunar year or during Ramadan when many choose to fulfill this obligation.

How to Calculate Zakat on Income

Calculating zakat on income involves understanding which parts of your earnings are subject to this obligation. This includes salary, bonuses, rental income from properties, and any other forms of income you receive.

- 1. Gather all sources of income for the year.

- 2. Subtract necessary living expenses (like rent or groceries).

- 3. Calculate zakat by applying the 2.5% rate to what's left.

Remember: Only excess income after necessary expenses is subject to zakat.

Utilizing Online Tools for Easy Calculation

Feeling overwhelmed? Don't sweat it! There are numerous online tools designed specifically for this purpose—think instant calculators that take into account current market values and help you calculate zakat accurately.

For instance, if you're in India, using a zakat calculator India or an Islamic charity calculator tailored for local conditions can make life easier while ensuring you're meeting your obligations correctly.

Utilizing Digital Tools for Accurate Zakat Calculation

Picture this: you're at a family gathering, and someone casually mentions their zakat calculation. Everyone nods knowingly, but inside, you're panicking because you've got no clue how to calculate zakat accurately. You're not alone—many Muslims feel the same way, which is where digital tools come to the rescue.

In a world where apps can help us find a date or navigate traffic, why should calculating zakat be any different? Enter the zakat calculator—a handy digital tool that takes the guesswork out of your annual obligations. With just a few clicks, you can ensure that you're correctly calculating zakat on savings, gold, and other assets without breaking a sweat.

The Benefits of Using a Zakat Calculator

Let's break down why using an accurate zakat calculator should be on your must-do list:

- Quick calculations: No more manual math errors—just input your details and let the calculator do its magic.

- Up-to-date values: Many calculators pull current market prices for gold and silver automatically, so you know you're working with accurate figures.

- User-friendly interfaces: Most online zakat tools are designed for ease of use; even your tech-challenged uncle could figure it out!

- Comprehensive guidance: Some calculators also provide insights into what qualifies as zakatable wealth based on local rules.

Pro tip: Always double-check the assumptions behind any online tool to ensure they align with your understanding of zakat rules.

Popular Zakat Calculators

Which one should I choose? you might ask. Here are some popular options tailored for different needs:

| Zakat Calculator | Features |

|---|---|

| Zakat Calculator India | Specifically designed for Indian users with local currency and nisab values. |

| Islamic Charity Calculator | 'Offers insights into donation allocation and eligibility. |

| Quick Zakat Estimation Tool | 'A straightforward interface for fast calculations without frills. |

| Wealth Purification Calculator | 'Focuses on ensuring all assets are considered in your calculation. |

But wait, you might wonder, what about privacy? Most reputable calculators prioritize user confidentiality. Just make sure to read their privacy policy before diving in!

Common Misconceptions in Zakat Calculation

It's astonishing how many people believe that zakat is solely about giving away a portion of their wealth without understanding the nuances involved. A recent survey revealed that nearly 65% of Muslims are unsure about what qualifies as zakatable assets. This confusion can lead to missed opportunities for fulfilling one's religious obligations.

Myth #1: Zakat is Just About Cash

Many assume that only cash in hand or savings accounts counts towards zakat. This is where things get tricky! Assets like stocks, bonds, and even gold jewelry are also subject to zakat. You wouldn't leave your beloved vintage car out of your insurance policy, would you? Similarly, all forms of wealth should be included in your zakat calculation.

Myth #2: You Can Calculate Zakat Once and Forget It

Picture this: you calculate your zakat one year and think you're set for life. Not quite! Wealth fluctuates—think of it like a rollercoaster ride. If your investments soar or plummet, so does your zakat obligation. Regularly checking your assets ensures you're not over- or under-contributing.

Myth #3: Zakat Only Applies to the Wealthy

I'm not wealthy enough to pay zakat, is a common refrain. But hold on! Zakat is meant to purify wealth, and if you meet the nisab threshold—even if it's just through savings or a small business—you're obligated to give. It's not about being rich; it's about fulfilling a spiritual duty based on what you have.

If it has value, it likely counts towards your zakat calculation.

Myth #4: Using a Zakat Calculator is Cheating

I should be able to do this manually, some might say. But let's face it—using an accurate zakat calculator isn't cheating; it's smart! These digital tools can help clarify complex calculations and ensure you're meeting your obligations correctly without the guesswork.

Navigating through the intricacies of zakat calculation doesn't need to feel like running a marathon without training. By debunking these myths and utilizing resources like a comprehensive zakat guide or an Islamic charity calculator tailored for India, you can confidently approach your annual obligations.

Zakat Distribution Guidelines: Where to Allocate Funds

Here's a thought: over 1.6 billion Muslims around the globe are required to give zakat, yet many struggle with where their hard-earned funds should go. It's like being handed a treasure map but having no idea how to read it!

Understanding zakat distribution is crucial because it's not just about the act of giving; it's about ensuring your contributions make a meaningful impact. The beauty of zakat lies in its ability to uplift communities, support the needy, and foster social justice.

Identifying Eligible Recipients

The Quran outlines eight categories of individuals eligible for zakat. This means you have options—think of it as a buffet where each dish serves a different purpose! Here are the key recipients:

- The Poor (Al-Fuqara): Individuals who lack basic necessities.

- The Needy (Al-Masakin): Those who may not be destitute but still struggle financially.

- Zakat Collectors (Al-Amilina 'Alaiha): Individuals appointed to collect and distribute zakat.

- Those Whose Hearts are to be Reconciled (Mu'allafatu Qulubuhum): New Muslims or those whose hearts need softening towards Islam.

- To Free Captives (Ar-Riqab): Supporting those seeking freedom from bondage.

- The Debtors (Al-Gharimin): Individuals in debt who cannot meet their obligations.

- In the Cause of Allah (Fi Sabilillah): Supporting religious causes and projects that benefit the community.

- The Wayfarer (Ibn As-Sabil): Travelers in need who find themselves stranded.

Important: It's essential to verify that your chosen recipients genuinely fit these categories.

How Much? – Understanding Zakat Allocation

How much should I allocate to each category? is a common question. While there's no strict formula, many scholars suggest distributing zakat proportionally based on local needs. For example, if you're in an area with high poverty rates, consider allocating more towards the poor and needy.

But what if I want to support educational initiatives or healthcare? Great question! Zakat can also fund projects that align with these values, such as providing scholarships or medical assistance. Just ensure that these initiatives directly benefit eligible recipients.

Incorporating digital tools like an online zakat donation calculator can also streamline this process by helping you track your contributions across different categories. This way, you can ensure you're fulfilling your religious duty while making a real difference.

As you consider where to allocate your zakat funds, remember that every contribution counts—whether it's helping a family pay rent or funding educational resources for children. Your generosity has the power to transform lives!

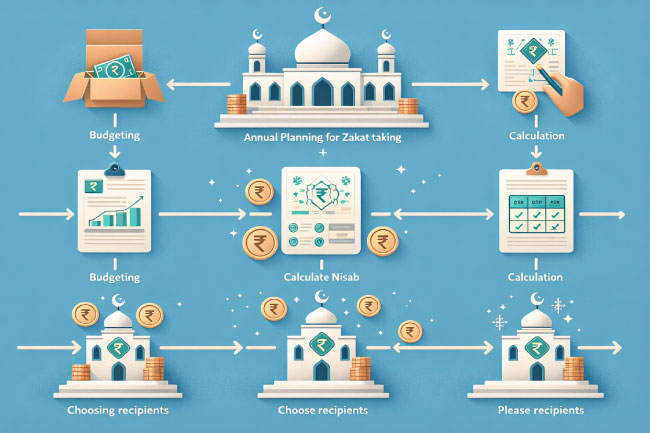

Annual Planning for Zakat Contributions

Imagine this: the end of the financial year is fast approaching, and you realize you've got a mountain of paperwork to sift through just to figure out how much zakat you owe. You're not alone; many find themselves in the same boat, scrambling at the last minute to calculate their zakat contributions. But what if I told you that with a little annual planning, you could breeze through this process like a pro?

Why Annual Planning is Essential

Annual planning for zakat contributions isn't just about crunching numbers; it's about setting yourself up for success. By taking the time to plan, you can ensure that your contributions are accurate, timely, and aligned with your financial situation. Plus, it helps you avoid those last-minute scrambles that can lead to mistakes or missed obligations.

Step-by-Step Guide to Annual Zakat Planning

Pro tip: Use an Islamic charity calculator or digital tools specifically designed for zakat calculation throughout the year to keep track of changes in your wealth.

Benefits of Regular Zakat Contributions

Why should I bother planning? you might ask. Well, regular contributions not only purify your wealth but also foster a sense of community and responsibility towards those in need. When done right, your zakat can significantly impact families struggling financially—restoring dignity and hope where it's most needed.

Fulfil Your Zakat

Easily calculate your zakat with our accurate zakat calculator. Ensure your charity is correctly distributed and fulfill your obligations.

👉 Calculate your Zakat Now